Hello folks! ![]()

Being an options trader myself, I’ve always been frustrated when I need to enter a trade quickly during a small window of an opportunity.

1. Go to the option chain

2. Choose the strike based on premium values and see how far out or deep they are

3. Then go see the strike chart

4. And after taking the position, get back to the underlying chart.

This friction always went unnoticed during the run to hit the trade opportunity, plus lost time/momentum. I’m sure there are many traders like me who feel this pain.

Tried the multi-chart (3) layout too, where the underlying was on my left half and the strikes on my right. It did help, but I missed big charts (why I love Tradingview charts) and the problem to navigate to different strike prices still existed.

Trade-from-charts is good for managing a position and entering the trade, but first I had to get to the charts!

This is what we’ve tried to solve with our Scalper Widget.

Just the basics right, but a huge win for ease and convenience. ![]()

What we’ve tried to solve majorly!

What we’ve tried to solve majorly!

- Navigating multiple scrips & strikes

- LTPs of the instrument/symbol

- Quick order entry & exit

- Monitoring the position while on a different/underlying chart

That’s it. There were a dozen of more things that we wanted to add, OI, IV, Delta, etc, etc. but it would only add to clutter instead of butter!

We even removed the depth option too (maybe add it later if a lot of users request it)., as most TV users have the “Shift+D” (shortcut to open DOM) habit for the depth anyway.

Here’s a quick walkthrough of the Widget interface. ![]()

Functions & capabilities of the Widget - Let’s dive in!

![]() Scrip & Chart controls

Scrip & Chart controls ![]()

- The underlying scrip of the widget switches directly to the chart in focus

- On switching, the strikes reset to ATM strike

- The LTP of the CE/PE strikes is visible in their respective sections

- A chart icon opens the needed chart in the focused/selected section of the layout

![]() Segment Modes

Segment Modes ![]()

- You can switch between Options, Futures and Equity too! We built his not just for scalpers, but for every chartist to conveniently navigate & trade across scrips!

- Futures and Equity modes have the “Reverse” position baked in

- In the options mode - you have access to switch between 5 closest expiries

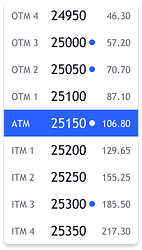

![]() The Options strikes navigator

The Options strikes navigator ![]()

- You can individually choose your preferred Call/Put strike from the dropdown

- The dropdown displays the Strikes, the premiums & the moneyness (ITM/OTM position)

- The strike price dropdown also shows a spot-dot that indicates an open position in the respective strikes.

![]() Strike Label (ATM / ITM / OTM) based Locking

Strike Label (ATM / ITM / OTM) based Locking ![]()

You can lock the strike price label based on the moneyness of the strike.

For example, if you choose to lock at the ATM, the strike price automatically changes as the underlying moves.

This enables you to keep your preferred strike based on the desired premium pre-loaded. And a swift trade can quickly be taken as you see your opportunity shot!

![]() Orders & positions!

Orders & positions! ![]()

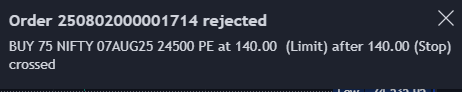

Orders

- Both the Calls and the Puts sections have dedicated Buy/Sell buttons. This negates a step to select PE or CE before placing a trade.

- You can choose between Market or Limit as the Order type

- The orders placed from the widget are Intraday - Instant orders

- All market orders are protected by default Market Price Protection (MPP)

- The Buy/Sell buttons take the quantity from the common Quantity input which is at the center of the Widget

- The Square off button exits the full position only for the selected strike.

- The square-off button is automatically enabled if there’s an open position in the selected strike.

Positions

- The Call and the Put sections show the open position for the selected strike.

- You get to view the Open quantity, average price and the unrealized P&L of the open position.

![]() Quick access to settings and Option Chain

Quick access to settings and Option Chain ![]()

- The option chain can quickly be accessed from the widget on clicking the option chain icon.

- You can open the Scalper settings directly as and when you need

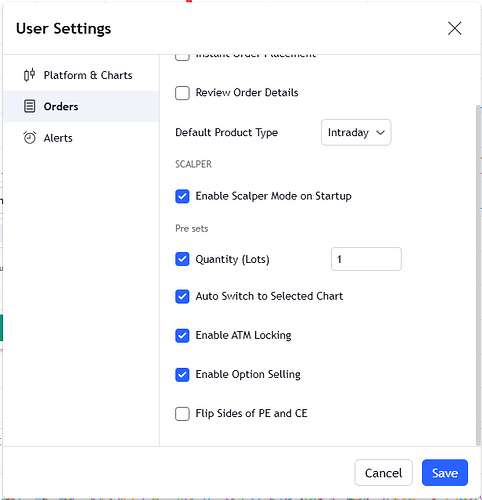

![]() Dedicated settings for the widget

Dedicated settings for the widget ![]()

Here, we’ve tried to make the experience personalized to your preferred trading style. You can choose to,

- Specify in your default quantity in lots. [We’ll be adding in more flexible options here like Money, % of money, etc. soon]

- Having the scalper launched and ready as soon as you log-in

- Enabling and disabling for ATM locking & Chart-switching (as explained in Section 1 above)

- Enable/disable Option selling - This acts like a safety switch when you’re exiting a Buy position in tranches. An additional extra click will make sure that you don’t short an option by mistake!

- Flipping sides of Calls and Puts - By default, the Calls section is on the right and the Puts on the left. If you prefer the other way around, this is the settings option for it. Go with however you feel comfortable!

This is kinda our initial take on a TV scalping widget. As we see more traction on it, we’ll be adding more features and sophisticated capabilities.

Stop-loss, Target, Trails, their pre-sets, Depth based orders, Flip position direction, quick info about OI/Greeks, and a lot more can be added to this. But eventually.

We wanted to have a clean & quick order entry first and then the rest to follow-on.

Hope to hear back on your experiences with this widget, with the added ease and convenience.

Happy Trading! ![]()

Best,

Mohit

Team Upstox

PS: We have something fun coming up in a few weeks. Its for trading, but not for trading! ![]()