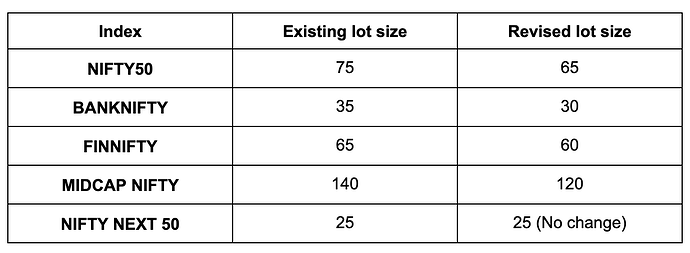

With effect from 28th October 2025, the lot sizes of index derivative contracts are being revised. This revision is based on the average closing price of the underlying indices for September 2025, ensuring that the contract value remains within SEBI’s prescribed range.

The current lot sizes will continue for all weekly and monthly contracts until 30 December 2025. From 30 December 2025 (EOD), the revised lot sizes will also apply to all quarterly and half-yearly contracts.

Here’s an overview of the changes in lot sizes:

Dates when the new lot sizes will come into effect:

Keep in mind:

-

From 20 Dec 2025, fresh positions with existing lot sizes in the quarterly or half-yearly series will not be allowed.

-

The lot-size revision will apply to NIFTY50 and BANKNIFTY quarterly and half-yearly contracts from 30 December 2025 (EOD).

-

In case there are open positions with existing lot size after 30 December 2025, you won’t be able to square them off after the revision and will need to hold them until expiry.

-

Dates may change if a trading holiday is declared.

In Case of a Long Position:

If you have a long (Option Buy) position with a quarterly/half-yearly expiry of March 2026 or later, you must exit the position on 30 Dec 2025. Otherwise, such positions may become worthless.

In Case of a Short Position:

If you have a short (Option Sell) position with a quarterly/half-yearly expiry of March 2026 or later:

Case 1: In multiples of the revised lot size

If your existing short position is in multiples of the revised lot size, you shall be permitted to trade in such contracts until restricted by Upstox.

Case 2: Not in multiples of the revised lot size

If your existing short positions are not in multiples of the revised lot size by 30 December 2025, we’ll partially or fully square off the short positions by 12 PM on 30 December 2025 to the best of our efforts.

This is being done as we won’t be able to square off such positions in case there is a margin shortfall after 30 December 2025.

![]() For more details, refer to the official NSE circular:

For more details, refer to the official NSE circular:

![]() FAOP70616 – NSE Circular on Index Derivative Lot Size Revision

FAOP70616 – NSE Circular on Index Derivative Lot Size Revision

Please keep these changes in mind while carrying out your derivative trades.