Understanding Chart Patterns from Scratch

What Are Chart Patterns

Chart patterns are structures formed by price movement on a chart over time. They emerge because market participants react similarly at certain price levels. Fear, greed, profit booking and accumulation repeat again and again, and this repetition creates patterns.

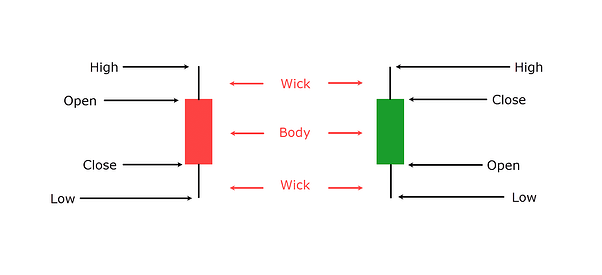

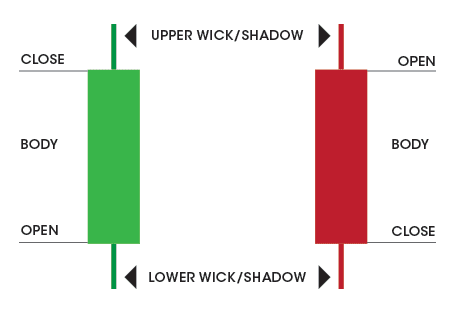

Chart patterns are built using OHLC candles:

-

Open: where price started

-

High: highest traded price

-

Low: lowest traded price

-

Close: where price ended

Important rule

Patterns are confirmed by candle closes, not by wicks alone.

Time Frames and Reliability

-

Lower time frames (1 to 5 min): faster, more noise

-

Medium time frames (15 to 30 min): best for intraday

-

Higher time frames (daily, weekly): fewer but more reliable patterns

Higher time frame patterns dominate lower time frame patterns.

Level 2: Intermediate

Reversal and Continuation Patterns Explained

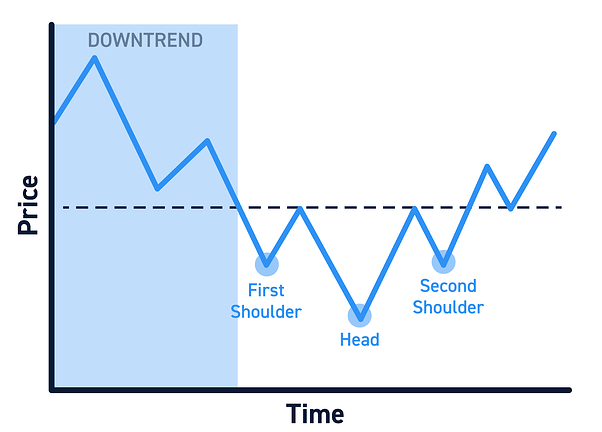

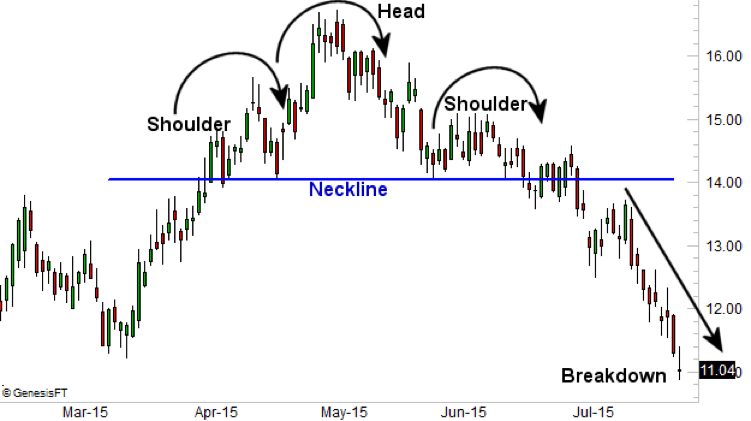

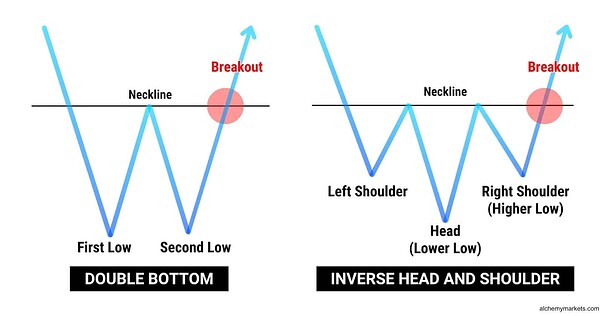

Head and Shoulders Pattern

Reversal Pattern

Structure

-

Left shoulder: price makes a high and pulls back

-

Head: price makes a higher high and pulls back

-

Right shoulder: price makes a lower high

-

Neckline: connects the two pullback lows

OHLC Confirmation

A strong candle close below the neckline confirms the reversal.

Real Example (Structure-Based)

Instrument: NIFTY

Time frame: 15 minute

-

NIFTY rallies from 21,900 to 22,200

-

Left shoulder forms near 22,150

-

Head forms near 22,240

-

Right shoulder forms near 22,160

-

Neckline around 22,050

A 15-minute candle closes below 22,050.

This confirms trend reversal.

Trade Plan

-

Entry: Below neckline close

-

Stop loss: Above right shoulder

-

Target: Distance from head to neckline projected downward

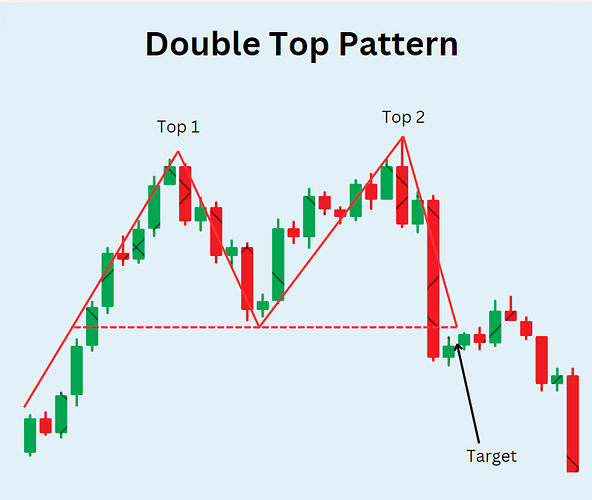

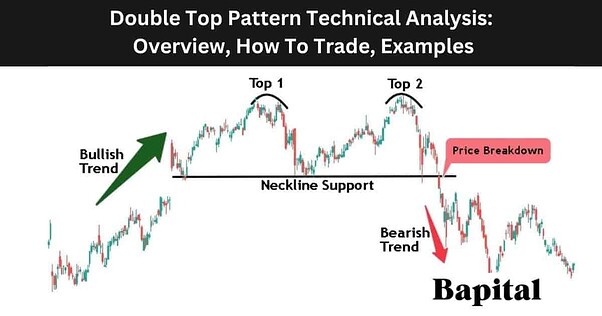

Double Top and Double Bottom

Double Top

-

Appears after an uptrend

-

Price fails twice at same resistance

-

Breakdown below middle low confirms reversal

Double Bottom

-

Appears after a downtrend

-

Price holds support twice

-

Breakout above middle high confirms reversal

Key mistake

Entering before confirmation.

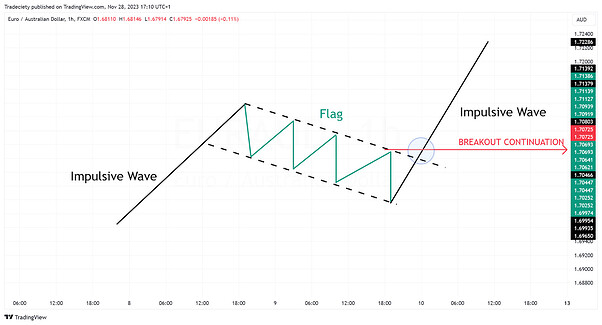

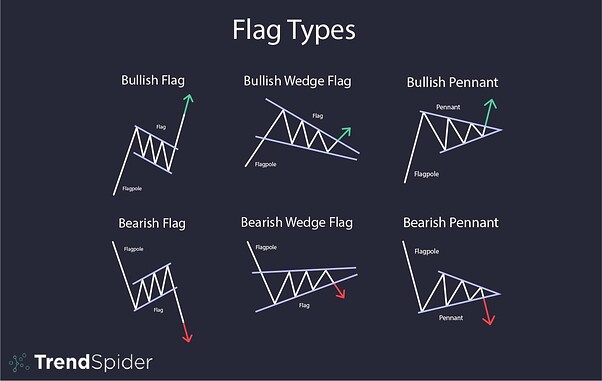

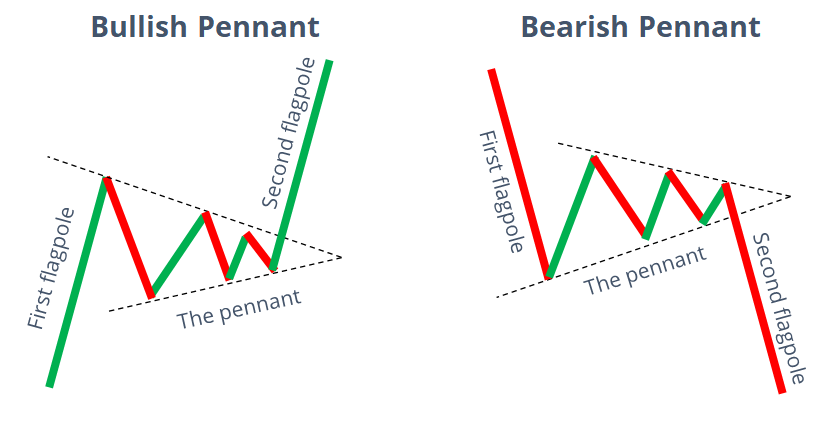

Flag and Pennant Patterns

Continuation Patterns

Flag Pattern Logic

-

Strong impulsive move (flagpole)

-

Short consolidation in opposite direction

-

Breakout continues trend

OHLC Behavior

-

Large candles during impulse

-

Small-bodied candles during consolidation

Real Example

Instrument: BANKNIFTY

Time frame: 5 minute

-

Price jumps 300 points in 20 minutes

-

Consolidates in a tight range for 6 candles

-

Breakout candle closes above flag

Trend continues.