Hi,

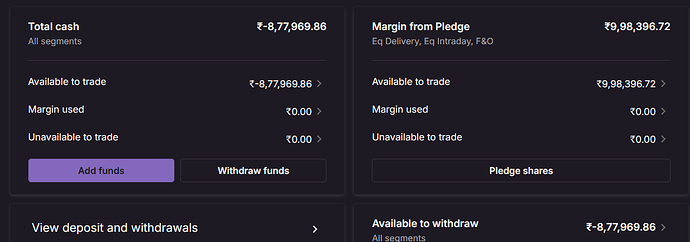

Due to insufficient funds in your account, some of your securities have been automatically pledged. To regain full control, please clear your outstanding balance.

What you need to do:

- Check your Upstox Wallet for the outstanding amount

- Add funds to clear the balance

- Once paid, your pledged securities will be released

Keep in mind:

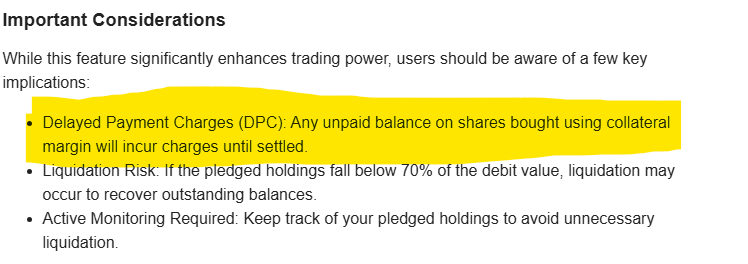

You have 5 days to clear your dues.

If your dues haven’t been cleared within the deadline, Upstox may sell the pledged securities as per SEBI regulations.

Have taken delivery trades using pledge margin, not sure why have got this as positions doesn’t exceed available margin

@KUMAR_1592631 -

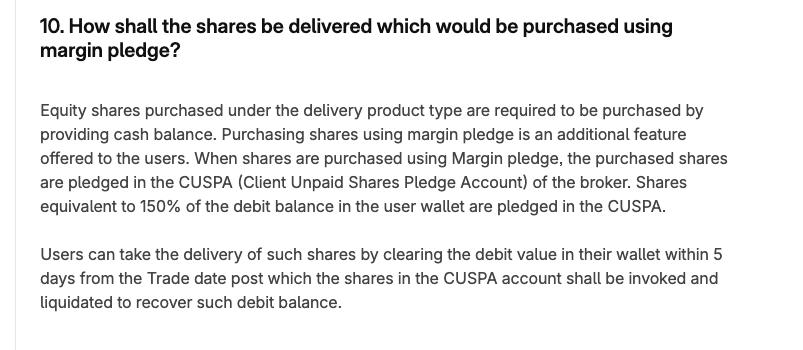

This is due to CUSPA. You can read more about it here: Help Center

Thanks.

Will the positions gets squared off no right

Have sufficient margin from mutual funds which are pledged

@KUMAR_1592631 -

Please note that if debit is not cleared within T+4 days, then on the 5th day, we proceed to sell the pledged stocks or mutual funds to recover the amount. Please check this for more details: Help Center

Need a clarification on this

We can use pledge margin for delivery trades right if yes then i should have not got this email

You can get delivery trades upto t+4 days. Bro they are just fooling us by advertising half info.

Hi @KUMAR_1592631,

There is no false advertising here and Upstox is transparent and compliant as needed by Exchange regulations.

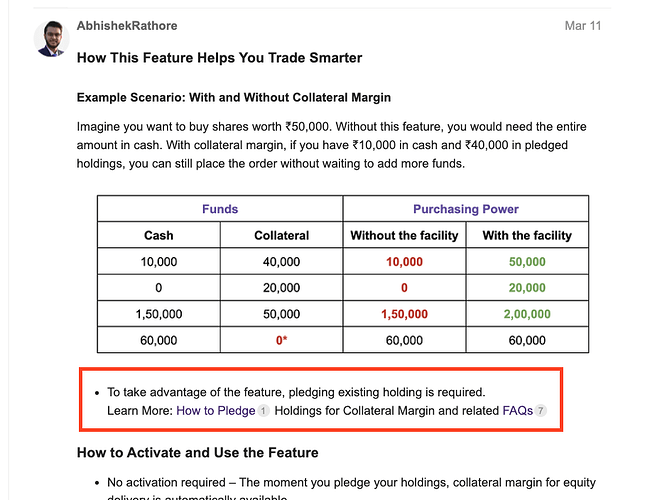

- Facility to buy equity delivery is offered by Upstox to its users and Upstox is only one of the few brokers to offer this facility.

- Upstox is transparent about the whole process and users get 5 days to pay the balance as per Exchange regulations.

- You can read more about the articles on this and our Margin Pledge policy below:

Article 1 - Maximizing Trading Potential: How to Use Collateral Margin for Equity Delivery

Do note: If you are unsure about the usage, we request you to keep the required amount in cash. This facility is provided to help the traders use their collateral for equity delivery trades. The collateral blocked is then released at EOD when the amount is billed to the user in cash. So, now user can take more trades using freed collateral and also has 5 days to repay the amount which he used to purchase equity delivery. Hope this clarifies your doubts.

@Ushnota In mentioned links, I could not find anywhere it is written like We need to clear debt within 5 days or our pledged stocks will be sold auto.

@Jagdish_j_ptl,

Our margin pledge policy is pretty transparent and linked to all the articles and shared multiple times in individual threads as well. Besides, T+5 is a standard policy mandated by the Exchange and Upstox has no control on it. Have attached screenshots below for reference:

You can check the below links too for better clarity:

You should have mentioned these things on main thread instead of giving small link thinking that all user will open it.

You can mention all these conditions but can’t mention that you need to settle debt within SEBI’s specified timeline that is 5 days currently. Great

Yeah have gone through your disclosures couldn’t find those specific info, disappointed honestly.

Guys, this is pretty standard and I see the issue being blown of proportion.

This is a standard practice to help traders buy equity delivery when they are short of cash.

The arguments doesn’t makes sense.

@KUMAR_1592631 to help you out. This is a standard procedure. Upstox is not going to sell your holdings. They assisted you to buy stocks when you didn’t have enough cash.

Now you are confusing this with taking F&O positions. Here you are not taking a position but actually buying a holding which needs to be settled in cash.

Upstox facilitated you to buy stocks when you had less cash, so that you can use collateral and settle the bill in 5 days. At end of the day, your collateral gets unblocked for you to trade more next day.

This is a win-win for traders. They can buy stocks when they find an opportunity even if they don’t have required cash and get flexibility to pay within 5 days.

Other arguments in the thread seems mis-directed and driven out of half knowledge.

To give you an advice or suggestion - if you are unsure of how to use collateral in segments other than Futures & Options Selling like Option Buying, EQ Intraday and EQ Delivery, keep required cash on hand as these last 3 segments have different collateral usage across brokers

Hope this resolved the confusion

@KUMAR_1592631 -

The article is just a reference point to explain the process in the Community. Margin Pledge policy is the main doc which is linked in to all marketing campaigns and email campaigns and also vetted by the Exchange itself for compliance.

Also, this is not in fine print and is approved by the Exchange whenever any communication is sent to an user regarding margin pledging. There is no foul play here and it is a standard policy in the industry. As mentioned earlier, you can keep cash in full to the amount of your purchase. Thanks.